| Article ID | Journal | Published Year | Pages | File Type |

|---|---|---|---|---|

| 5086371 | Japan and the World Economy | 2010 | 8 Pages |

Abstract

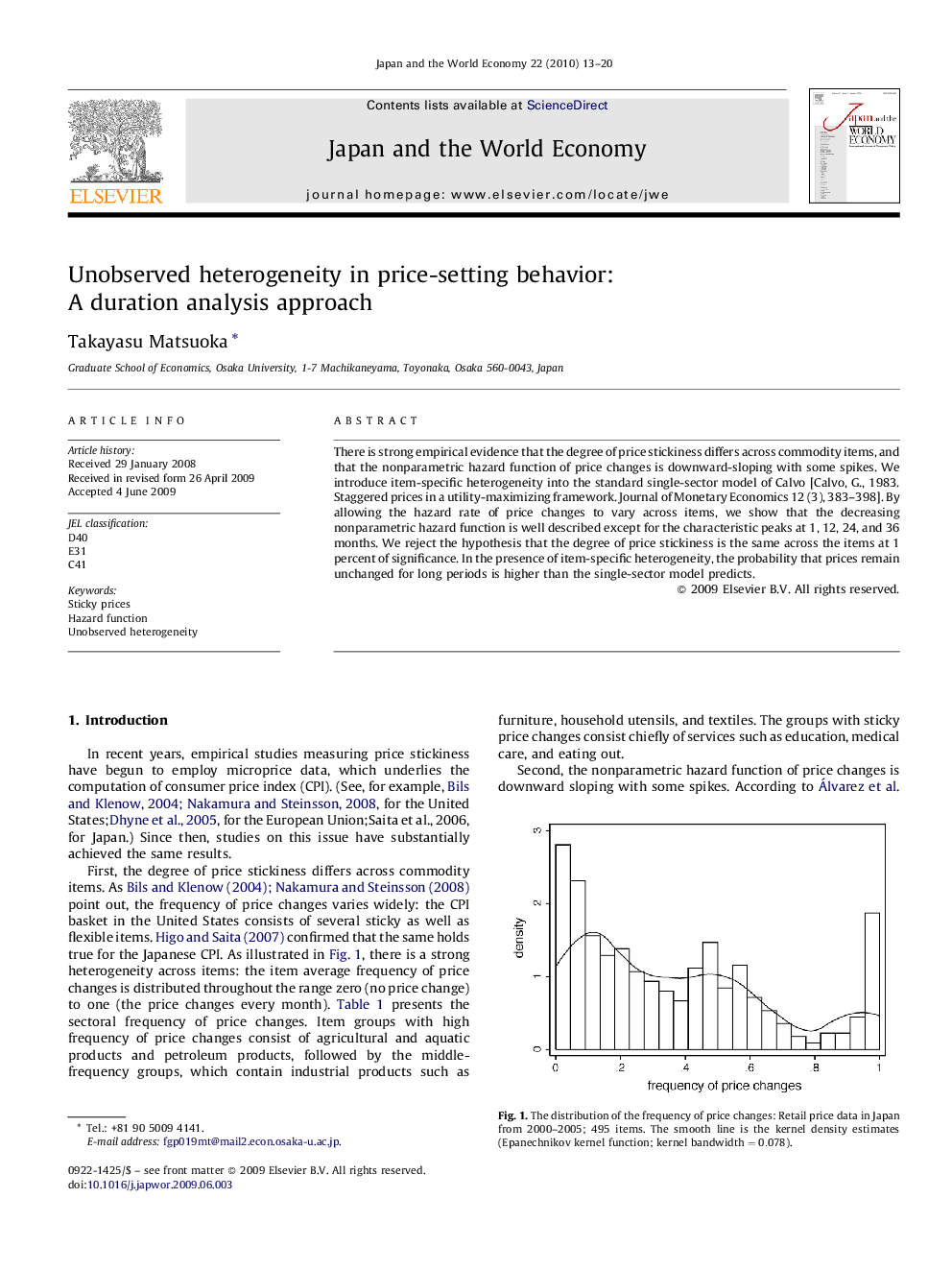

There is strong empirical evidence that the degree of price stickiness differs across commodity items, and that the nonparametric hazard function of price changes is downward-sloping with some spikes. We introduce item-specific heterogeneity into the standard single-sector model of Calvo [Calvo, G., 1983. Staggered prices in a utility-maximizing framework. Journal of Monetary Economics 12 (3), 383-398]. By allowing the hazard rate of price changes to vary across items, we show that the decreasing nonparametric hazard function is well described except for the characteristic peaks at 1, 12, 24, and 36 months. We reject the hypothesis that the degree of price stickiness is the same across the items at 1 percent of significance. In the presence of item-specific heterogeneity, the probability that prices remain unchanged for long periods is higher than the single-sector model predicts.

Related Topics

Social Sciences and Humanities

Economics, Econometrics and Finance

Economics and Econometrics

Authors

Takayasu Matsuoka,