| Article ID | Journal | Published Year | Pages | File Type |

|---|---|---|---|---|

| 717575 | IFAC Proceedings Volumes | 2012 | 5 Pages |

Abstract

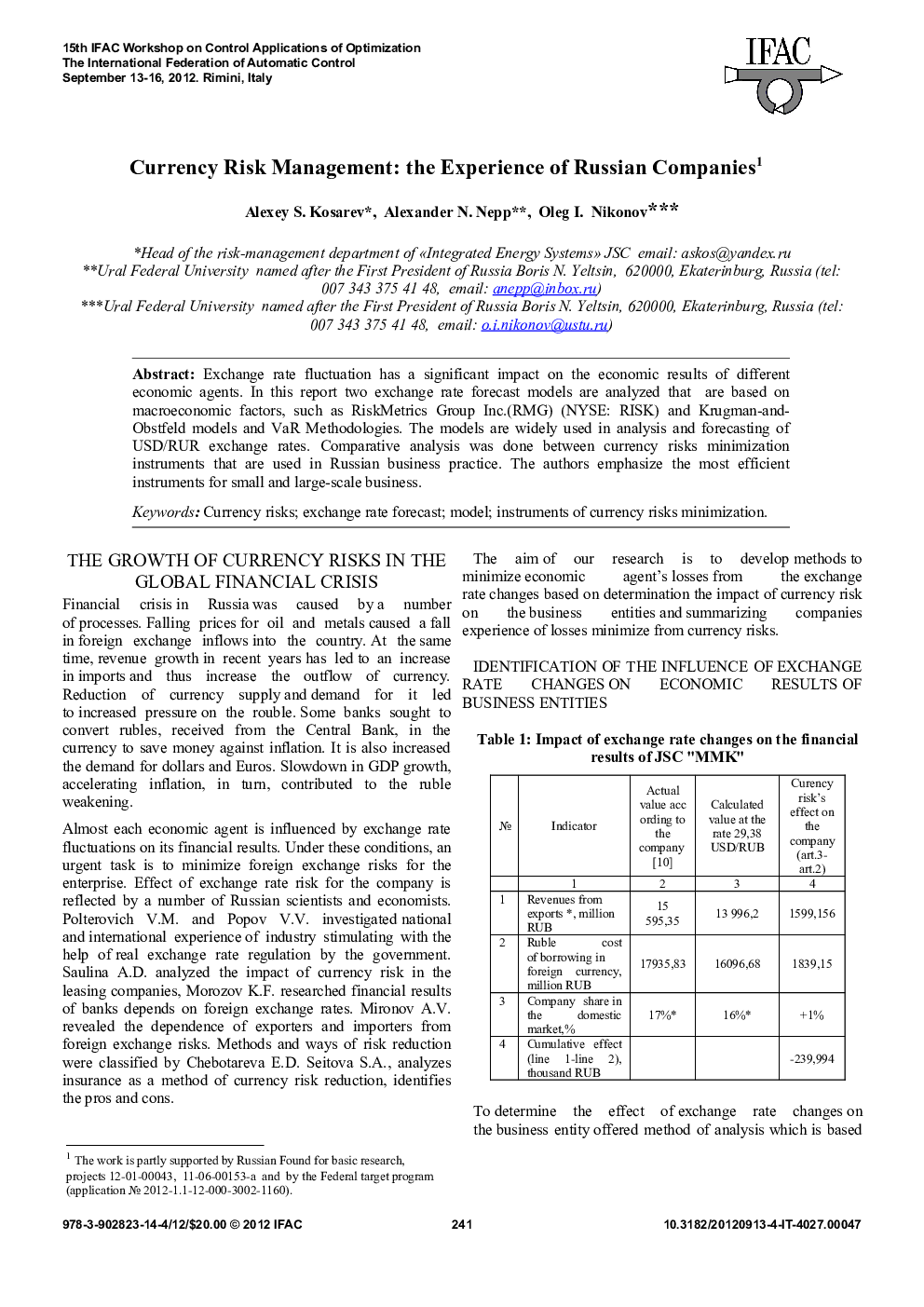

Exchange rate fluctuation has a significant impact on the economic results of different economic agents. In this report two exchange rate forecast models are analyzed that are based on macroeconomic factors, such as RiskMetrics Group Inc.(RMG) (NYSE: RISK) and Krugman-and-Obstfeld models and VaR Methodologies. The models are widely used in analysis and forecasting of USD/RUR exchange rates. Comparative analysis was done between currency risks minimization instruments that are used in Russian business practice. The authors emphasize the most efficient instruments for small and large-scale business.

Related Topics

Physical Sciences and Engineering

Engineering

Computational Mechanics