| کد مقاله | کد نشریه | سال انتشار | مقاله انگلیسی | نسخه تمام متن |

|---|---|---|---|---|

| 5064675 | 1476717 | 2014 | 10 صفحه PDF | دانلود رایگان |

- Time-varying weak form efficiency in energy futures markets is investigated.

- Crude oil and gasoline futures prices with 1-4Â months to maturity display efficient behavior in most of the time.

- For 5-8Â months to maturity, crude oil and natural gas futures prices are more efficient than others.

- Heating oil and gas oil futures prices exhibit predictable behavior for most of the time.

- Market efficiency decreases with increasing time to maturity.

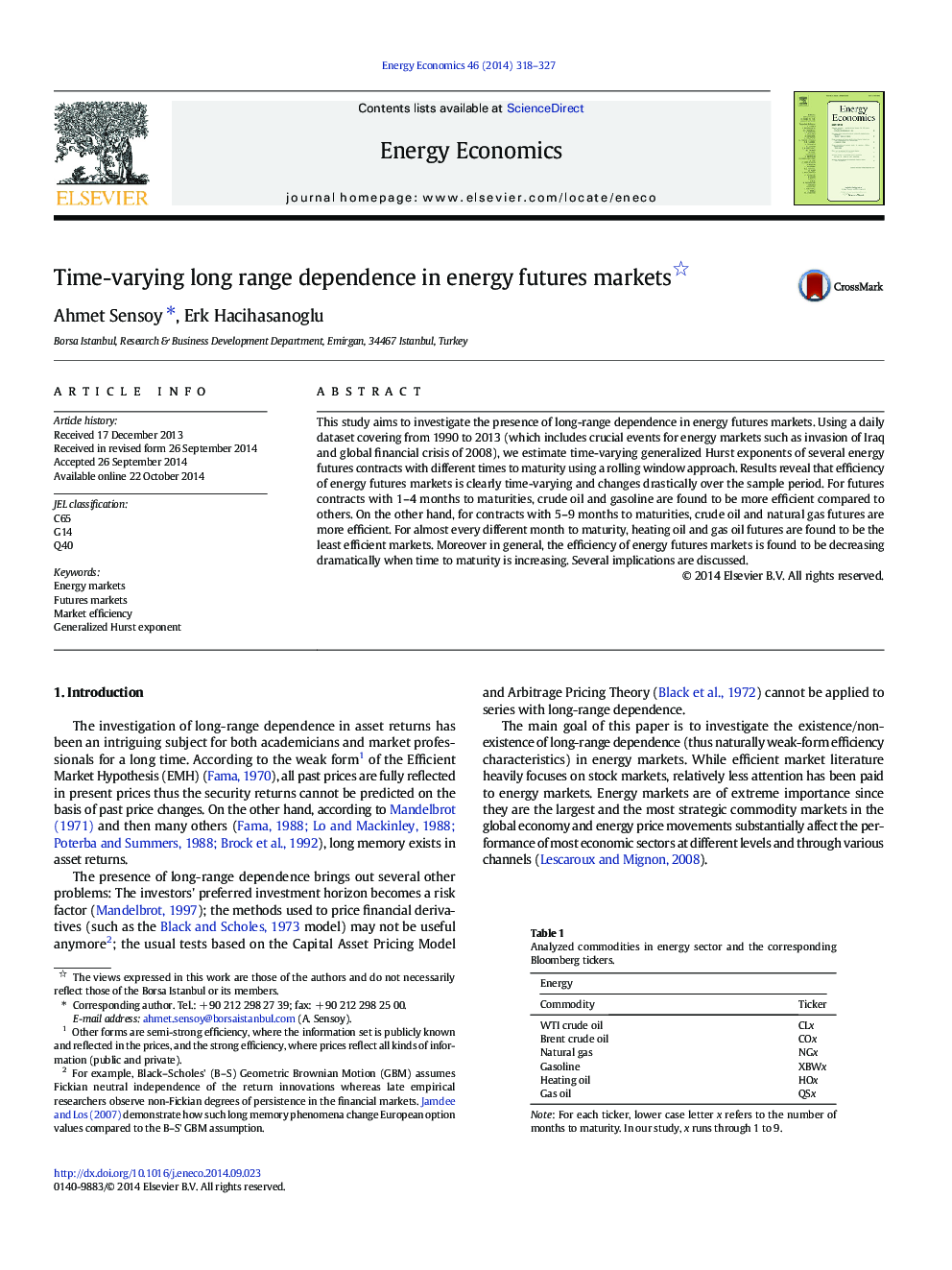

This study aims to investigate the presence of long-range dependence in energy futures markets. Using a daily dataset covering from 1990 to 2013 (which includes crucial events for energy markets such as invasion of Iraq and global financial crisis of 2008), we estimate time-varying generalized Hurst exponents of several energy futures contracts with different times to maturity using a rolling window approach. Results reveal that efficiency of energy futures markets is clearly time-varying and changes drastically over the sample period. For futures contracts with 1-4Â months to maturities, crude oil and gasoline are found to be more efficient compared to others. On the other hand, for contracts with 5-9Â months to maturities, crude oil and natural gas futures are more efficient. For almost every different month to maturity, heating oil and gas oil futures are found to be the least efficient markets. Moreover in general, the efficiency of energy futures markets is found to be decreasing dramatically when time to maturity is increasing. Several implications are discussed.

Journal: Energy Economics - Volume 46, November 2014, Pages 318-327